![The Spanish SL vs. U.S. LLCs from a tax point of view In Spain[1]](https://ustaxweb.azurewebsites.net/wp-content/uploads/2019/06/selfemployed.png)

by Antonio Rodriguez | Apr 9, 2021 | FATCA, IRPF Spanish Tax Return, IRS - Internal Revenue Service, Uncategorized

In Spain In Spain (1) an individual can develop an economic activity as self-employed (autónomo). Autónomos must register in the Social Security and must fulfill their tax obligations. The most common form of a Spanish company is (2) the SL Sociedad Limitada, the...

by Antonio Rodriguez | Feb 18, 2021 | AEAT, Finances, IRPF Spanish Tax Return, IRS - Internal Revenue Service, Modelo 720, Spanish Tax Return for non-residents, US Tax Return 1040 / 1040NR

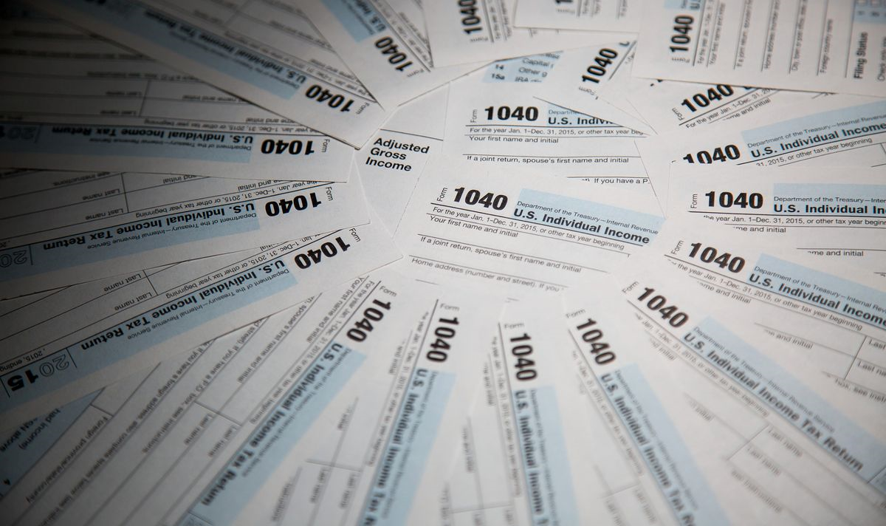

Important Tax Dates on 2021 2021 AEAT & Banco de España IRS & FinCEN HM Revenue & Customs Kingdom of Spain U.S.A. United Kingdom January, 15 Due date for Estimated Tax Form 1040-E 4th 2020 January, 20 Statistical Department of the Bank of Spain Form ETE:...

by Antonio Rodriguez | Jan 10, 2021 | AEAT, FATCA, FBAR, IRPF Spanish Tax Return, IRS - Internal Revenue Service, Modelo 720, Spanish Tax Return for non-residents, US Tax Return 1040 / 1040NR

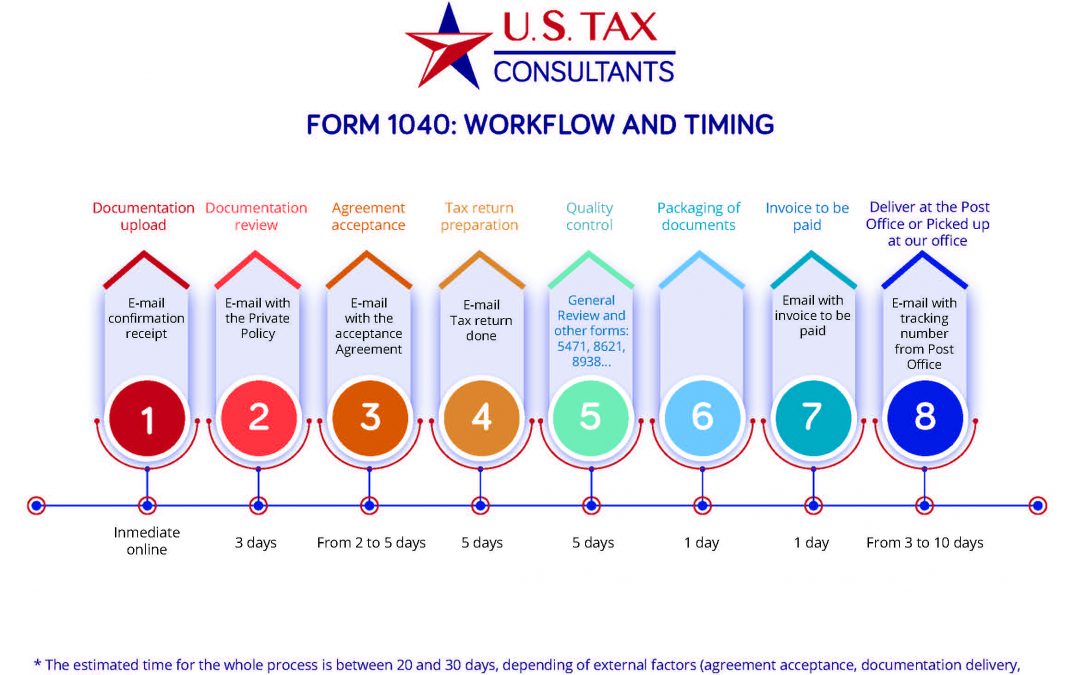

The 4 fiscal obligations for expats in Spain. All U.S. Citizen you are required to file a U.S. Individual Tax Return every year, wherever in the world they live, reporting your worldwide income, even if you pay taxes in Spain. You must file (1) the Form 1040...

by Antonio Rodriguez | Jan 6, 2021 | AEAT, IRPF Spanish Tax Return, IRS - Internal Revenue Service, Modelo 720, US Tax Return 1040 / 1040NR

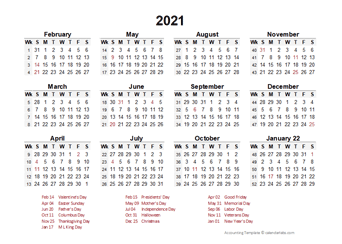

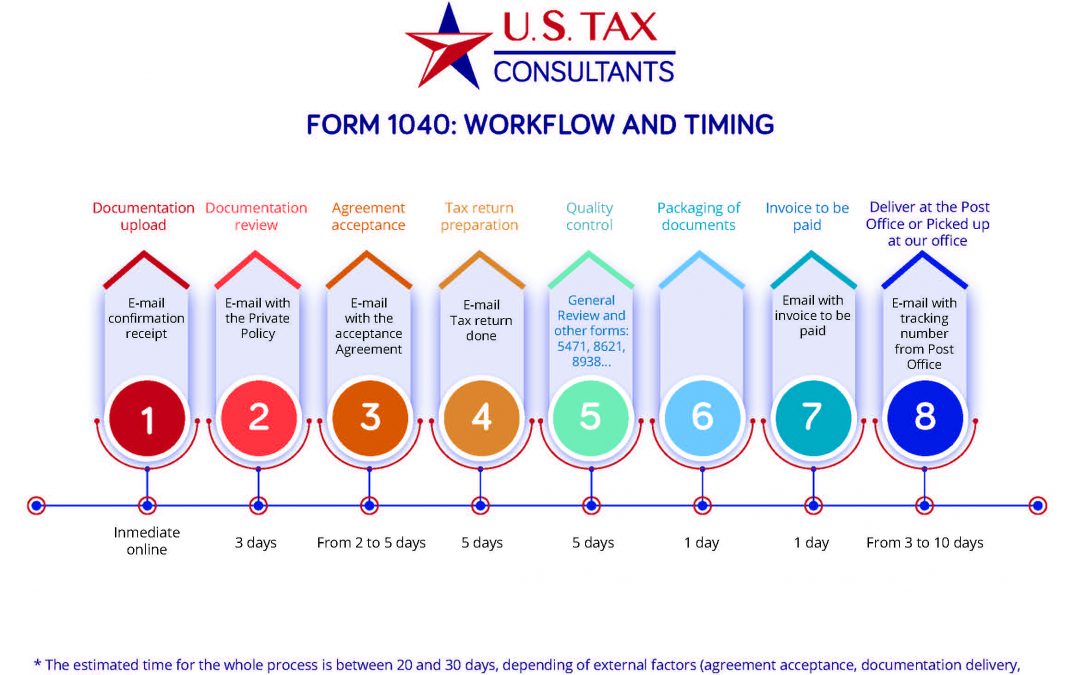

In order to offer a better service, U.S. Tax Consultants has developed an information system that allows our clients to know in which phase of the preparation process your return is. A process that consists of eight different phases and of which the client will be...

by Antonio Rodriguez | Nov 16, 2020 | Business, FBAR, IRPF Spanish Tax Return, IRS - Internal Revenue Service, Uncategorized, US Tax Return 1040 / 1040NR

We have selected that six need-to-know tax issues for expats to bear in mind before preparing their US Tax Returns: Mutual Funds, US bank account, CTC, tax preparation, Streamline Procedure and how to pay the IRS 1. “Fondos de Inversión” outside the U.S. All US...

by Antonio Rodriguez | May 10, 2020 | FATCA, FBAR, IRPF Spanish Tax Return, US Tax Return 1040 / 1040NR

You must file a Form 1040 is you are a US Person (US citizens, Green Card holders and resident Aliens), no matter where you live or if you pay taxes in a foreign Country. Normally the deadline for filing is April 15th but this year has been extended for everybody...

![The Spanish SL vs. U.S. LLCs from a tax point of view In Spain[1]](https://ustaxweb.azurewebsites.net/wp-content/uploads/2019/06/selfemployed.png)

![The Spanish SL vs. U.S. LLCs from a tax point of view In Spain[1]](https://ustaxweb.azurewebsites.net/wp-content/uploads/2019/06/selfemployed.png)

Recent Comments